Taxes

All outstanding taxes must be paid to the County.

Residents of Galahad and Strome are subject to Flagstaff County’s property tax rates in addition to any local improvement levies or special taxes imposed by the County on Galahad and Strome properties.

For the most current mill rate, click HERE to visit the County’s Taxation page.

Utilities

Waste Management (Garbage) Services

The County is a member of the Flagstaff Regional Solid Waste Management Association. Waste management services are provided through the regional waste association.

Utility Rates

The new utility bylaw (Bylaw 03-23 – Utilities Bylaw) for hamlets was approved by Flagstaff County Council.

The principle of ‘cost-recovery accounting’ was applied to determine the rates for water, sewer and garbage services. These rates reflect the costs of providing a safe drinking water system and the cost of the solid waste collection requisition. An infrastructure fee for water ($34 monthly) and for sewer ($23.50 monthly) will apply to all accounts, regardless of whether water services have been disconnected. The consumption charge for water consumed in excess of the monthly base rate of 15 cubic metres will be $4 per cubic metre.

Click HERE for important information about utilities.

Utility/Tax Payments

Payment Options:

Cheque, cash or debit in person at the Flagstaff County Office:

12435 Twp Rd 442

Sedgewick, AB

Via Mail:

Flagstaff County

P.O. Box 358

Sedgewick, AB T0B 4C0

Other Options:

- Pre-Authorized Utility Payment Plan: Our Pre-Authorized Utility Payment Plan allows you to have your monthly Utility Invoice automatically debited from your personal chequing or savings account on the statement due date. You are eligible for the Plan if your account is not in arrears. This authorization allows Flagstaff County to adjust your monthly payments as required to ensure your monthly Utility invoice is paid in full. You may withdraw from the plan by giving notice in writing before the 15th of the month preceding the next payment date. If your property is sold, title transferred or you have a change in bank account information, it is the responsibility of the participant to inform the Finance Department in writing. We require the notice of change before the 15th of the month prior to the next withdrawal. Click HERE to apply.

- Tax Installment Payment Plan (TIPP): Flagstaff County offers a pre-authorized payment plan that allows property owners to pay their property taxes to the County in monthly installments from January to December each year. The deadline for enrollment is June each year. Payments are automatically withdrawn from your bank account on the first business day of each month. Your most recent annual tax levy is divided by 12 to establish a monthly payment amount. Payment amounts will be adjusted in June to compensate for changes in taxes resulting from the annual tax levy. Payments begin January 1st of the new year and continue for 12 consecutive months. You may withdraw from the plan by giving notice in writing before the 15th of the month preceding the next payment date. If your property is sold, title transferred or you have a change in bank account information, it is the responsibility of the participant to inform the Tax Department in writing. We require the notice of change before the 15th of the month prior to the next withdrawal. Click HERE to apply.

- Debit Payment at the County Office

- Option Pay (Note: Option Pay allows you to pay with credit card only. There is a fee based on the amount paid. Please ensure that comment section includes account number when making payment to ensure that we are able to process payment correctly.)

- Vision Credit Union – Internet or in person banking for Taxes only

- ATB Financial – online

- BMO – Bank of Montreal

- TelPay

- E-Transfer

Remittances from outside Canada must be in Canadian Funds.

Email: county@flagstaff.ab.ca with questions.

Water and Wastewater Infrastructure

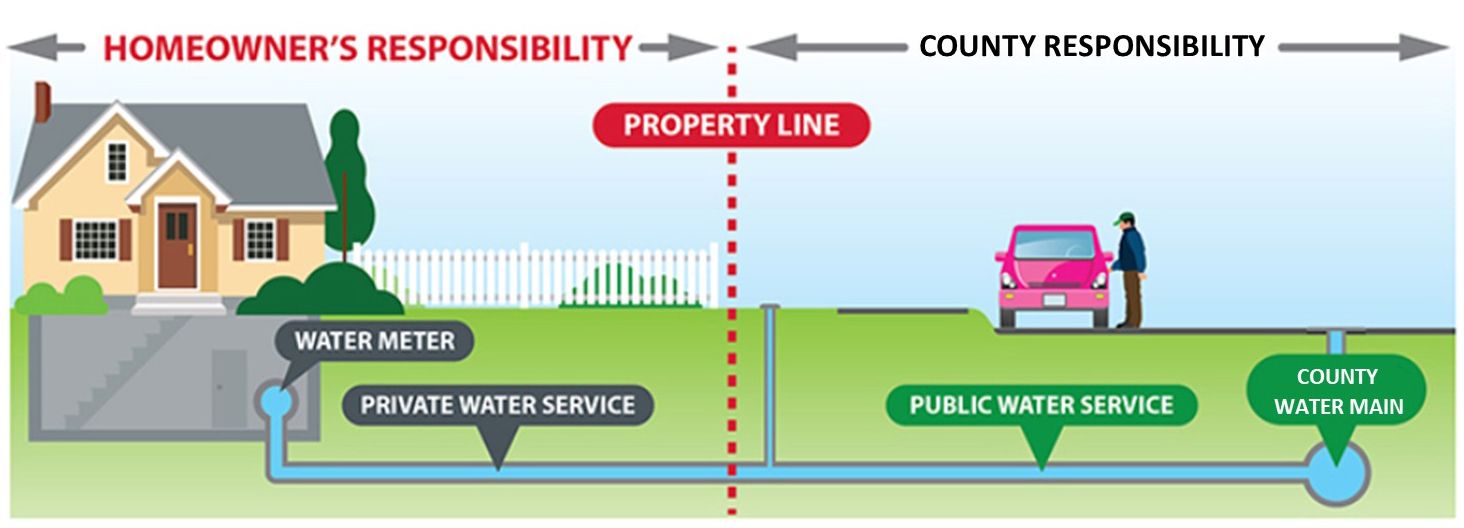

Please note, all water and wastewater infrastructure located on the resident’s side of the property line is the responsibility of the resident to maintain and replace as shown in the diagram below. Please ensure water and wastewater infrastructure such as water meters are properly insulated and protected from environmental factors; residents will be responsible for the cost for any repair or replacement of infrastructure on the resident’s side of the property line.

If your water meter becomes frozen, please contact a plumber.