The Assessment Department establishes and maintains property valuations (assessments) for all property within Flagstaff County for the purposes of distributing annual property taxes. We provide annual valuations for approximately 8,800 County properties, including the Hamlets of Galahad and Strome.

Click HERE to request tax assessment information about your property.

Understanding your property assessment

Property assessment is the process of assigning a dollar value to a property for taxation purposes. In Alberta, property is taxed based on the ad valorem principle. Ad valorem means “according to value.” This means that the amount of tax paid is based on the value of the property. Assessed values are based upon regulated assessment and market value assessment. Regulated assessment applies to four types of properties; farmland, linear, machinery and equipment, and railway. Market value is used to determine all other properties such as residential and non-residential.

Market value

The market value-based standard is used to determine the assessed values for the majority of properties in Alberta. Market value is the price a property might be expected to sell for if sold by a willing seller to a willing buyer after appropriate time and exposure in an open market.

Key characteristics of market value are:

- It is the most probable price, not the highest, lowest, or average price.

- It is expressed in terms of a dollar value.

- It assumes a transaction between unrelated parties in the open market.

- It assumes a willing buyer and a willing seller, with no advantage being taken by either party.

- It recognizes the present use and potential use of the property.

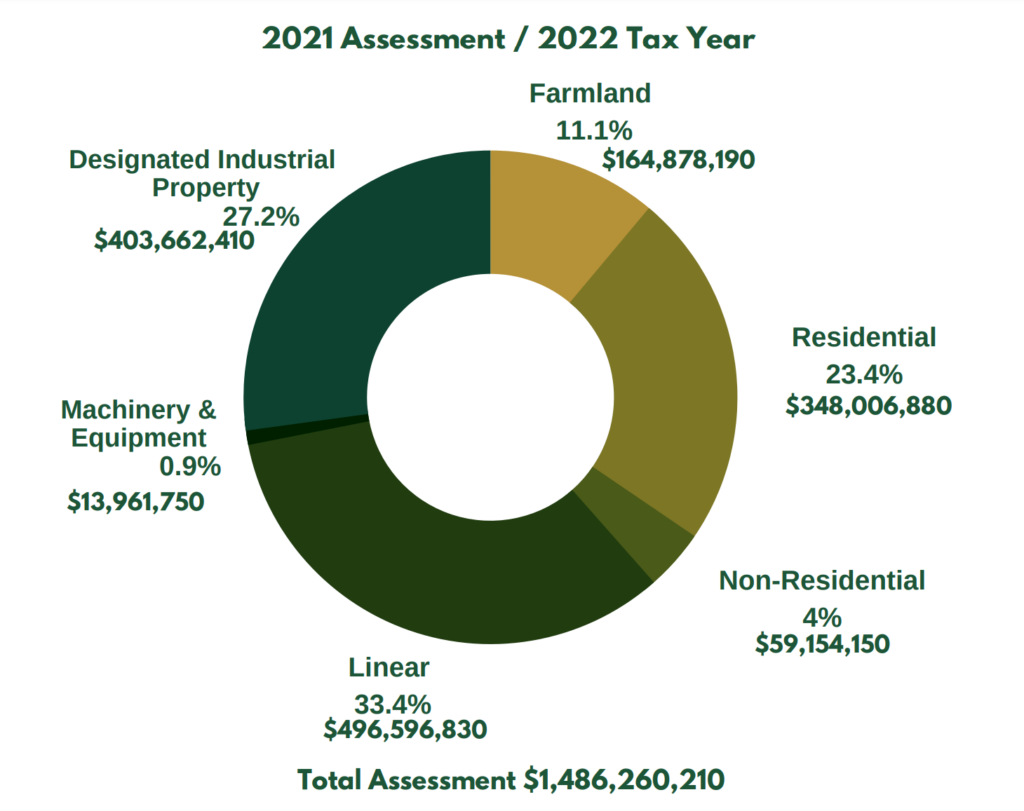

Assessment summary

Regulated assessment

Some types of properties are difficult to assess using a market value-based assessment standard because:

- They seldom trade in the marketplace. When they do trade, the sale price usually includes non-assessable items that are difficult to separate from the sale price.

- They cross municipalities and municipal boundaries.

- They are of a unique nature.

Municipal Affairs prescribes rates and procedures to assess these types of properties, which are referred to as “regulated property”. Rates and procedures are determined by what a type of property is used for, its activity, or its production capability.

There are four types of regulated property:

- Farmland

- Linear property

- Machinery and equipment

- Railway property

Farmland

Farmland is assessed based on its productive value; that is, the ability of the land to produce income from the growing of crops and/or the raising of livestock. The productive value of farmland is determined using a process that sets a value for the best soils, and then adjusts for less-than-optimum conditions, such as stones, the presence of sloughs, or topography.

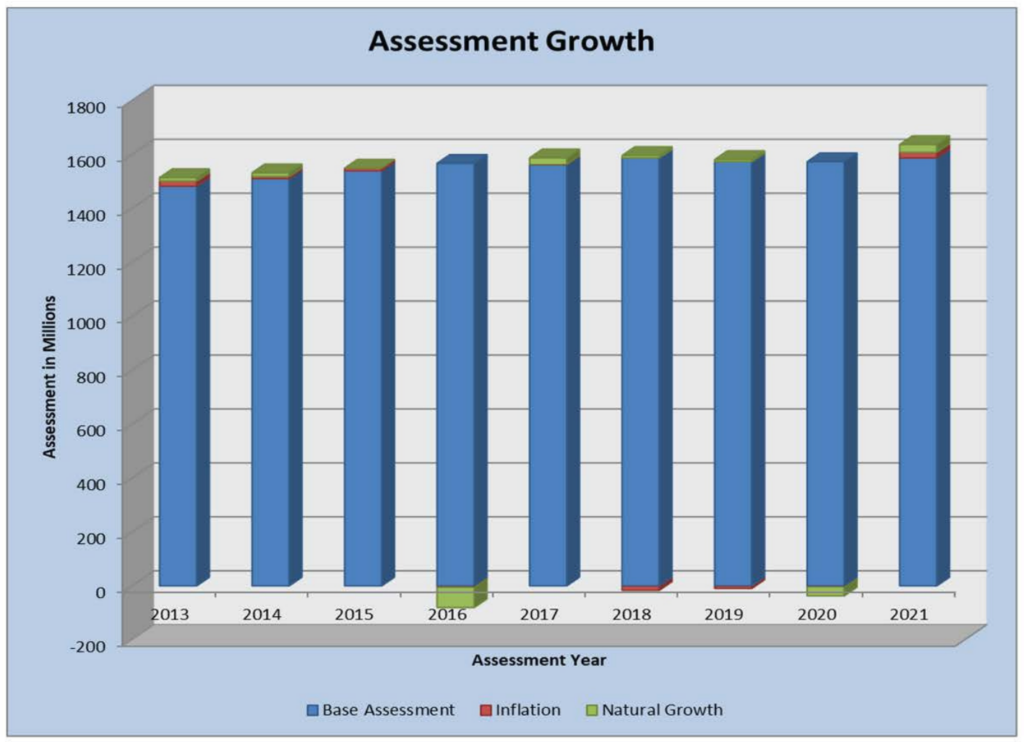

Assessment Growth

Flagstaff County continues to contract the assessment services to Accurate Assessment Group Ltd. Accurate Assessment Group Ltd. was incorporated on April 16, 1997 in the province of Alberta. Since that time, they have developed a track record of performance with municipalities across the province.

Accurate Assessment Group employs highly knowledgeable and experienced staff. Using Geographic Information Systems, they have pioneered the way assessments are being analyzed, which allows them to provide a more efficient and effective assessment of the highest quality.

Assessment Complaint and Appeal System

To ensure that property owners have a voice in the property assessment system, the Municipal Government Act has set out a complaints and appeals system for property owners who have concerns about their assessment. The process was reviewed and changed in 2009 and now involves two assessment review boards, divided by complaint types. Complaints of residential properties with 3 or less dwelling units or farmland are to be heard before the Local Assessment Review Board (LARB) and assessment complaints on non-residential properties and residential properties with 4 or more dwelling units will be heard by the Composite Assessment Review Board (CARB).

The first step an assessed person should take if he or she believes his or her property assessment is unfair or inaccurate is to contact the assessor. The assessor can be reached by calling the County office at (780) 384-4100. The assessor may request to inspect the property to determine if an error was made. If the assessor agrees that the original notice is not accurate, a corrected notice may be issued. If the assessor and the property owner cannot come to an agreement, the property owner may begin the formal complaint process by filing a complaint. Complaint forms for this process can be retrieved from the County office or by clicking the following link.

Assessment Review Board Complaint Form

The deadline for filing a complaint is noted on the tax notice. The fee schedule per property type is also noted on the tax notice. Please note that complaints about taxes and tax rates are not valid reasons for an appeal. Assessment review boards cannot change the tax rates or the services provided by the County. When filing a complaint, follow the instructions on your tax notice, and fill out a complaint form.

You can either deliver the completed form in person, by fax, or by mailing it to the Flagstaff County office, Chief Administrative Officer, at the following:

In Person: 12435 Twp Rd 442

Mail: Flagstaff County, Assessment Department, Box 358, Sedgewick, AB T0B 4C0

Fax: (780) 384-3635

Please note that if any changes occur to your property (i.e. building removal, renovations, taxable status, etc.), notify the County.

A tax agent (anyone acting on your behalf for assessment complaints) must fill out the following form.

Assessment Complaints Agent Authorization Form

If you have any questions regarding Assessment, please contact Sean Cosens, Accurate Assessment Group:

Accurate Assessment Group Ltd.

780-464-4655

171 Pembina Road

Sherwood Park, AB T8H 2W8

www.aag-gis.com

Contacts